How to identify the best price, selection and size for your product portfolio - webinar overview

Cambri Features

This article is about our webinar on how to identify the best price, selection and size for your product portfolio for maximum impact. Read on for a summary of the session or click here to watch the recording.

When entering a new market or launching a new product range, a company needs to make several business decisions at once. Advanced research methods such as MaxDiff, TURF and CB-conjoint can be a huge help in determining the best price, selection and size for your product portfolio. In this webinar, Cambri experts show how you can use these methods to make the necessary business decisions.

00:01:50 Meet our speakers

Host, Anna Sundelius, Customer Success Manager at Cambri, introduces the speakers:

Outi Somervuori, PhD, Co-founder and Head of Research at Cambri, with expertise in behavioural pricing.

Apramey Dube, PhD, Senior Research Manager at Cambri, with expertise in customer experience and value creation.

Watch the webinar to hear a real-life story about how Apramey’s uncle founded a tea company in India and how that relates to this webinar’s topic!

00:05:50 What's on the agenda

Before diving into the details, we take a quick look at the main topics to be covered in the session:

- Iterative product portfolio optimisation with the Cambri tool and Managed Services (10 min)

- Product preferences and segments (MaxDiff) (10 min)

- Product portfolio with the best reach (TURF) (10 min)

- Q&A (5 min)

- Find the best packaging size and price (CB-conjoint) (15 min)

- Summary and conclusions (5 min)

00:07:00 Introducing the case study: Tasty Tea

Outi introduces the hypothetical test case: a tea company called Tasty Tea. The company is planning to enter the UK tea market and to do so, they have to make several business decisions:

1. What are the optimal customer segments to target?

2. Product portfolio design:

- Which tea flavours should be included in the product portfolio?

- How many tea flavours should the portfolio consist of?

- What would the right package size be?

- What would the optimal package price be?

00:09:05 Recommendations on how to make these decisions using the right tools

Cambri recommends a three-step iterative approach to help Tasty Tea make their business decisions:

- Step 1: Understand the product preferences and segments using the MaxDiff method.

- Step 2. Optimise portfolio content and size using the TURF method.

- Step 3: Optimise package size and price using CB-conjoint analysis.

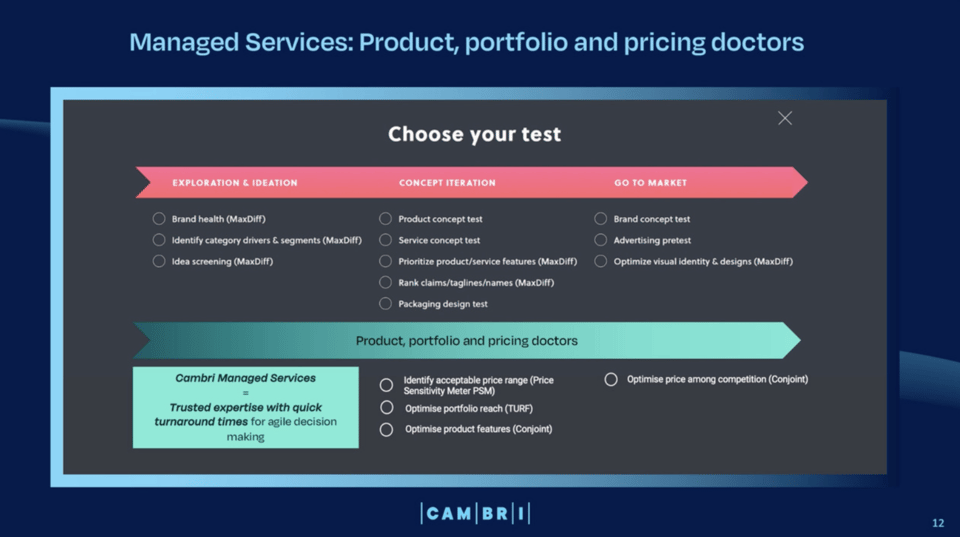

00:10:35 How Cambri Managed Services can help you get more out of the Cambri tool

The Cambri tool features a multitude of tests you can run on your own. Cambri also offers additional support to help you make the right decisions on portfolio and product features and pricing. Cambri’s Managed Services is a full-service solution where Cambri experts plan the research framework together with the client, provide test templates, run the research and analyse the results. Because Managed Services makes use of the Cambri platform, delivery time is just two to four weeks – much shorter than what traditional research agencies typically offer.

00:13:38 Case example: How we used MaxDiff to understand which product preferences and segments to focus on

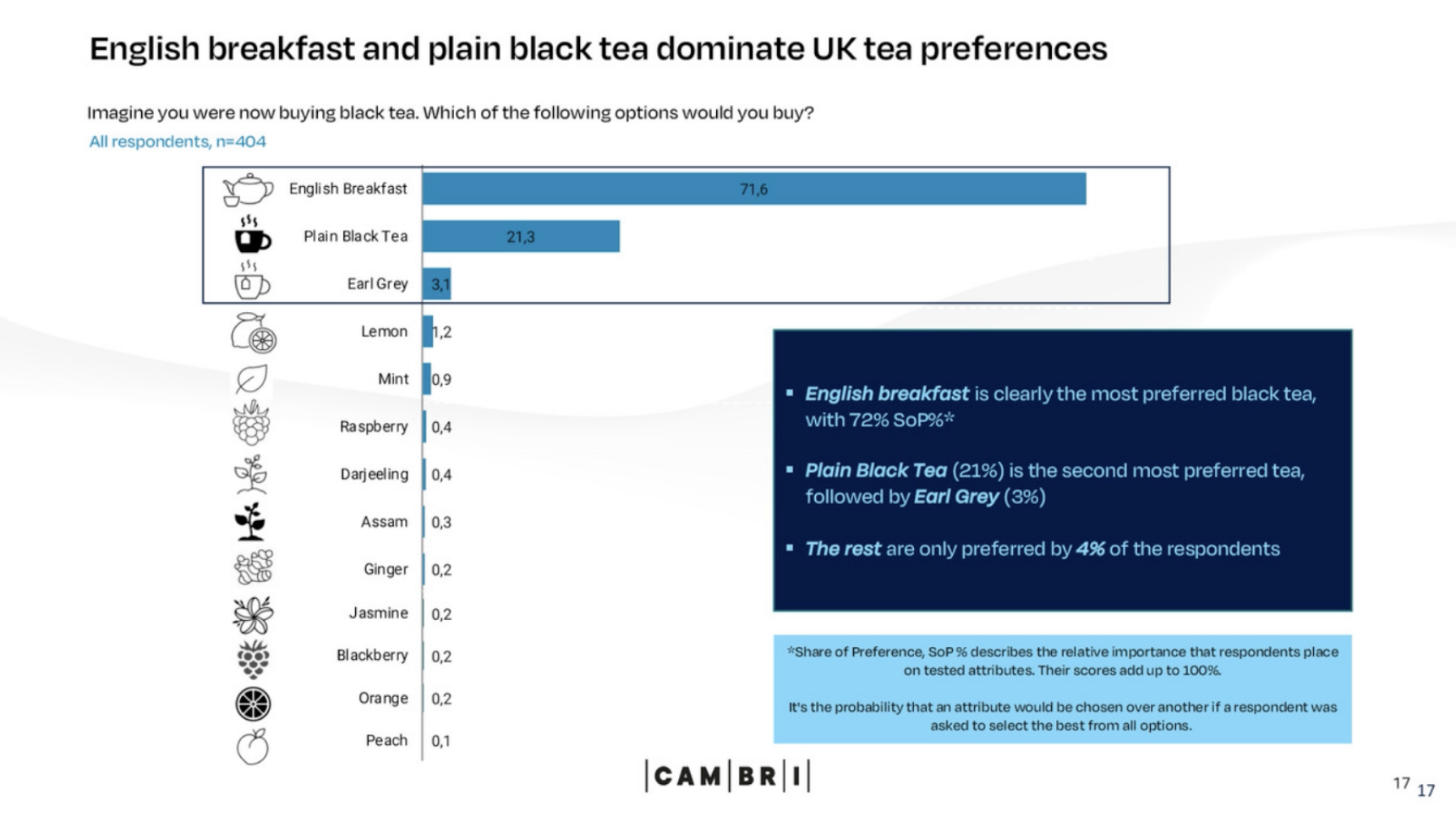

To find out which tea flavours should be included in Tasty Tea’s selection, we created a MaxDiff (Maximum Difference Scaling) test with thirteen flavours of black tea. The respondents were asked to choose their favourite and least favourite flavours. The test results showed which flavours the respondents preferred and what share of the votes each flavour received.

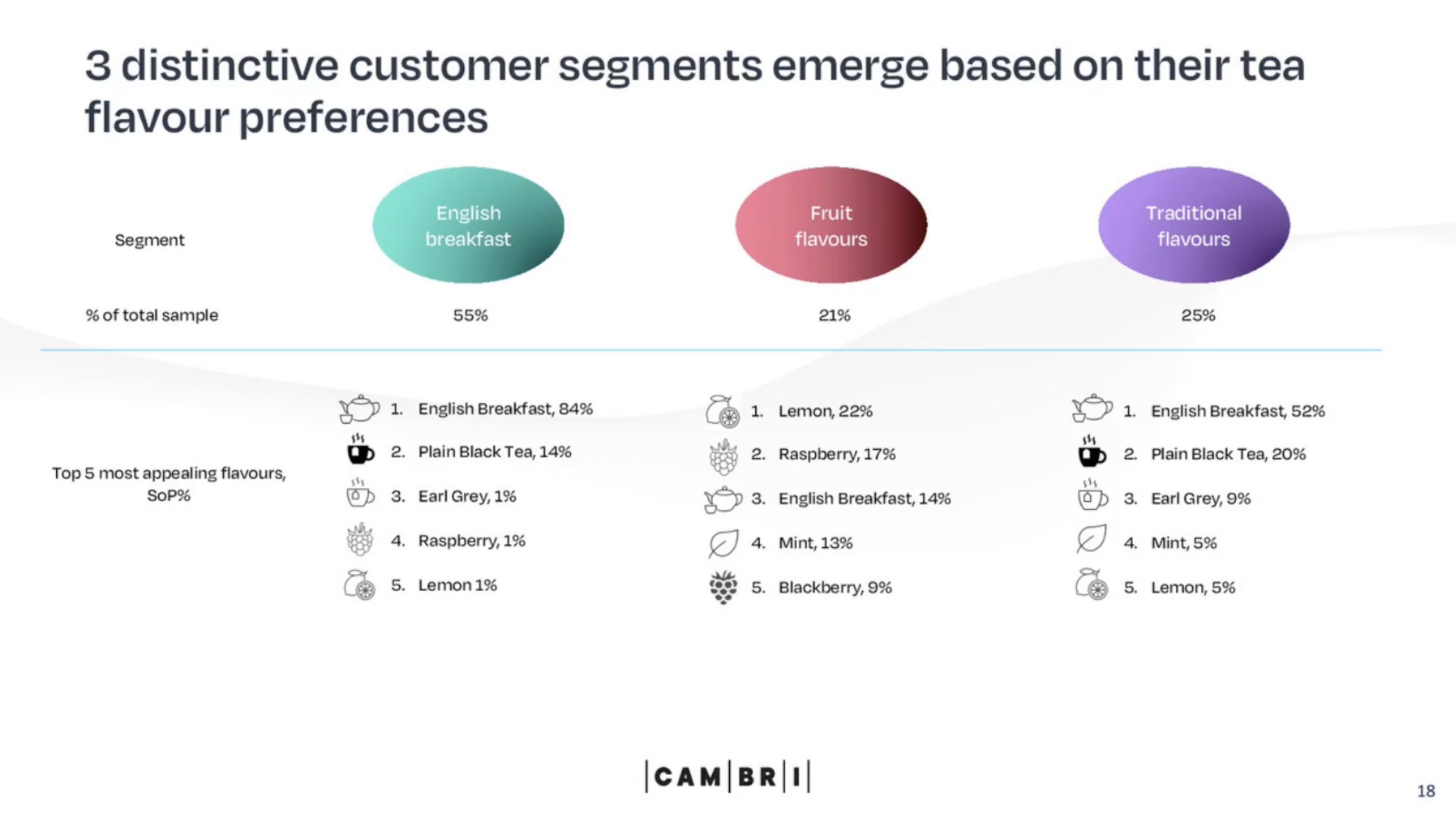

Even though English breakfast was shown to dominate the preference rankings, the test results revealed two other customer segments that could be interesting for Tasty Tea: fruit flavours and traditional flavours.

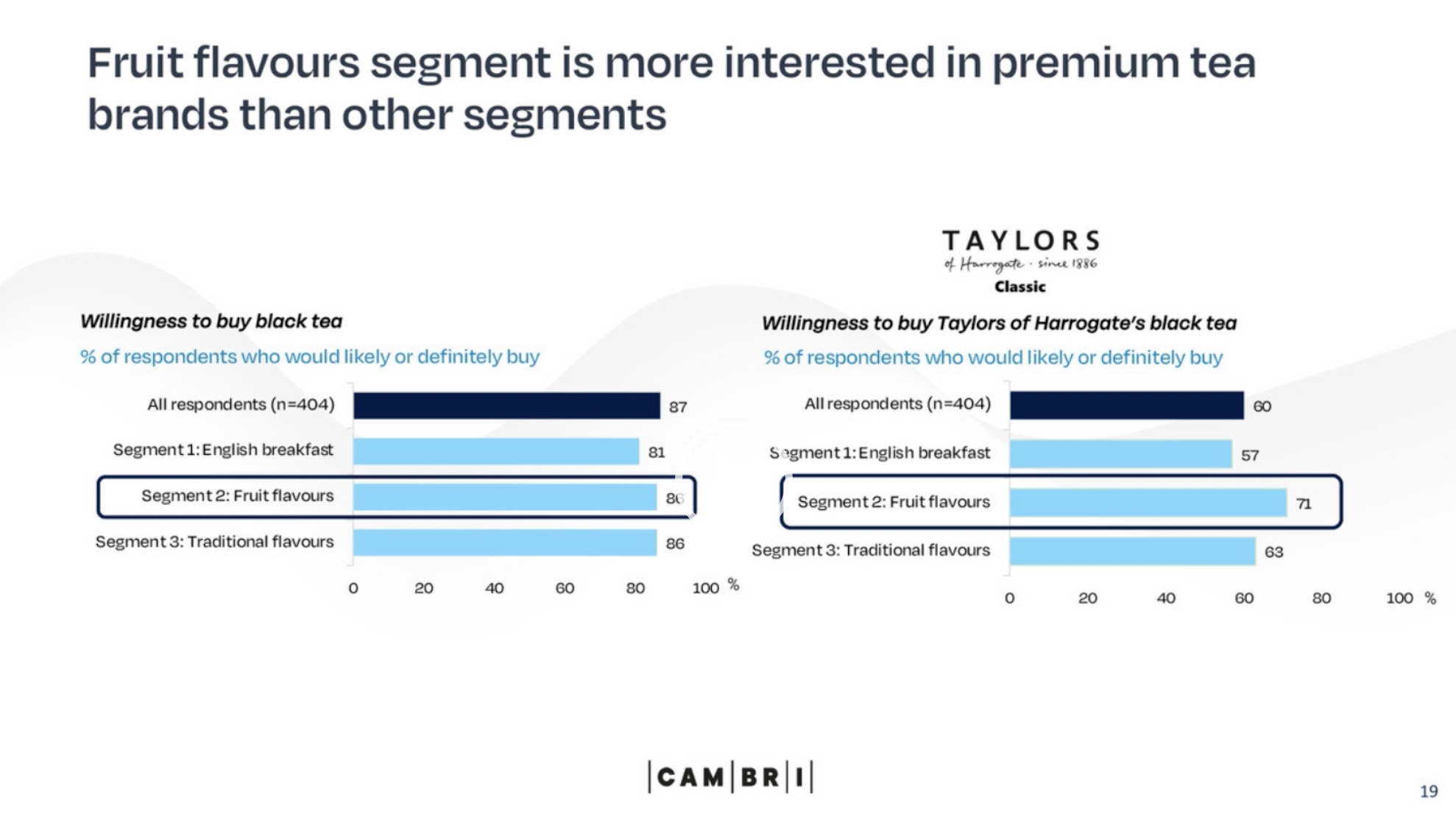

The MaxDiff method also allows us to dig a bit deeper into these three segments and see what else drives tea purchasing behaviour. The following results show that all three segments were heavily inclined to buy black tea and didn’t differ from each other too much in this regard.

However, as Tasty Tea is a premium tea brand, they were interested to know how likely these segments were to buy their black tea from premium brands. The results show the respondents who liked fruit flavours were also most likely to buy tea from premium tea brands. The conclusion we were able to draw here was that the fruity flavour segment could be a very interesting target market for Tasty Tea.

00:21:41 Case example: How we used the TURF method to optmise portfolio content and size

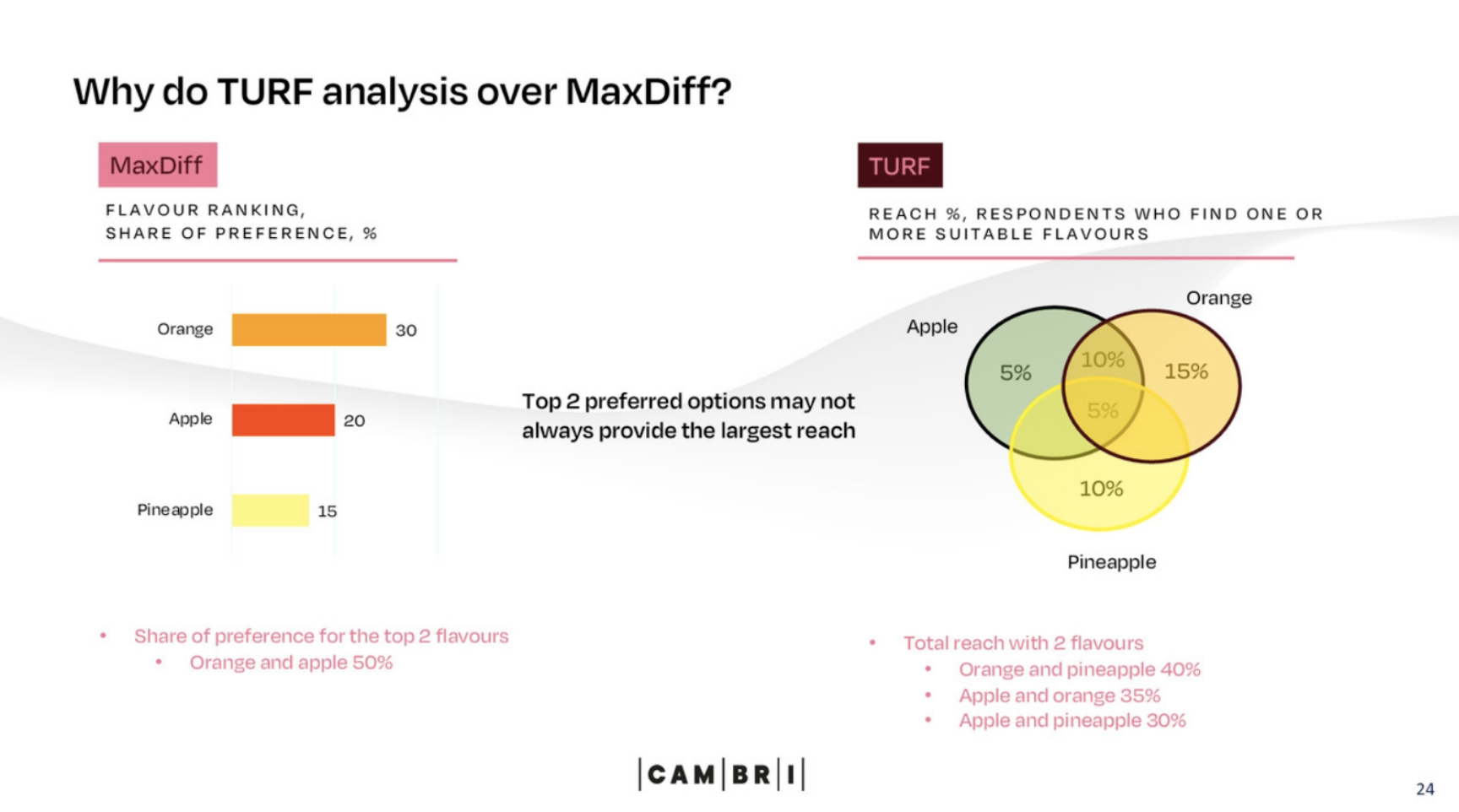

While MaxDiff is a superior method in revealing consumers’ true preferences, TURF (total unduplicated reach and frequency) can drill down these results by identifying the difference between the most preferred option and the second or third options.

This will then tell us the reach of each flavour, i.e. the percentage of respondents who would buy it. TURF tells us about the average frequency, i.e. how easy it is for a respondent to find all their preferred flavours in the selection.

TURF results can help increase the odds of every respondent finding at least one of their favourite flavours in the selection.

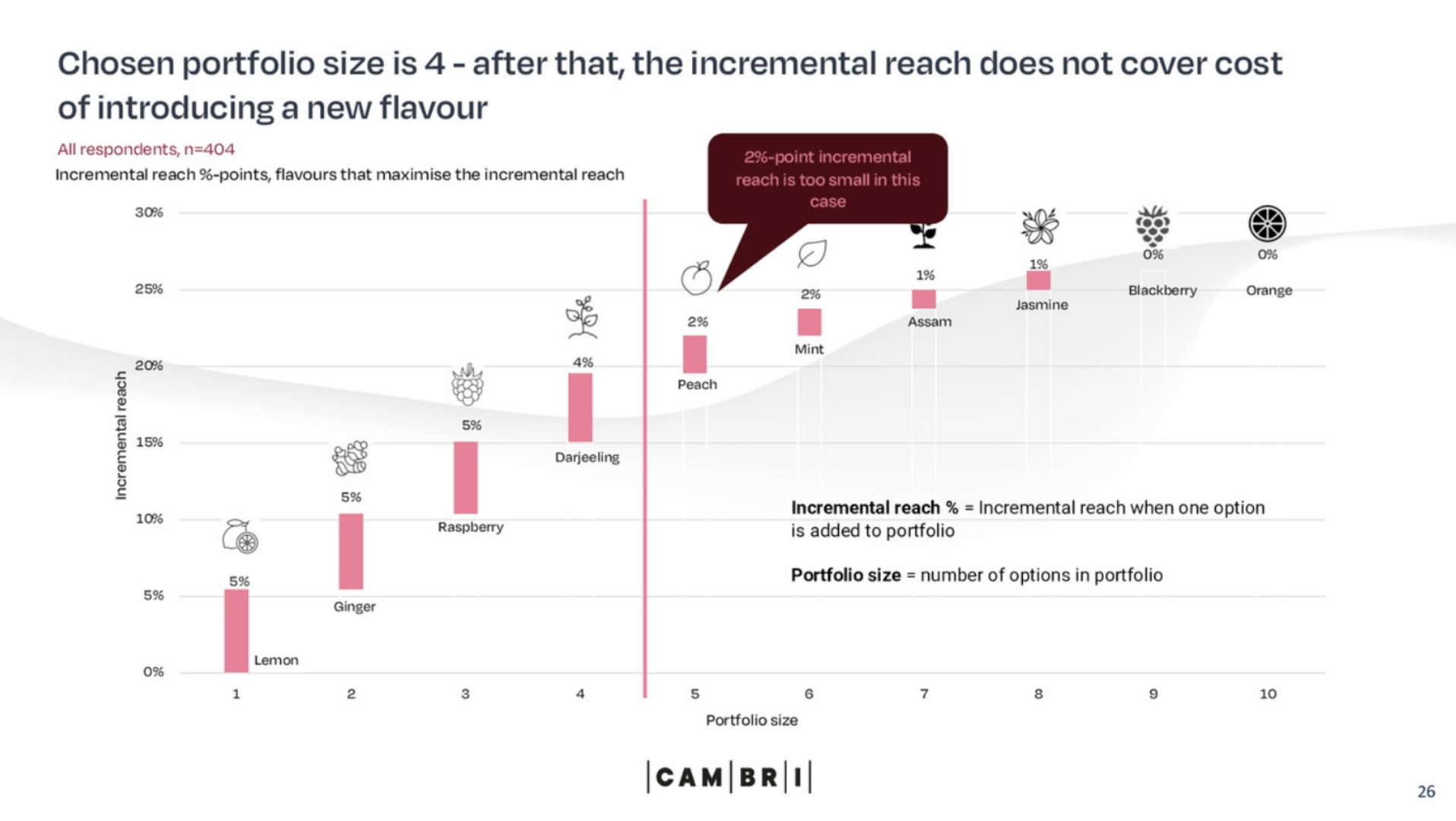

The conclusion we could draw from TURF was that the optimal size of the fruit tea selection for Tasty Tea was four. We also identified the flavours that wouldn’t be worth trying because they would not increase the reach enough to justify the costs of introducing a new flavour.

00:27:29 Key takeaways from MaxDiff and TURF

By utilising MaxDiff and TURF, we were able to find the optimal customer segment to target, understand how many alternative tea flavours should be included in the product portfolio, and determine the expected market size in the UK.

00:30:48 How we used CB-conjoint analysis to find the best package size and price

Tasty Tea wanted to find the optimal package size and price.

The CB-conjoint method allowed us to simulate the potential demand for Tasty Tea packages compared to existing brand packages and prices. We first carried out the test with the current package sizes and then with new package size options. Next, the test was expanded to analyse alternative package size and price scenarios for maximum market share and/or revenue.

Watch the webinar to find out how changing the package sizes and prices changed Tasty Tea’s position among other tea brands, and which size and price would offer the best results.

You’ll also learn how to use CB-conjoint analysis to understand your product’s price sensitivity, i.e. how demand changes if and when prices change.

00:45:32 Key takeaways from CB-conjoint analysis

Based on the CB-conjoint analysis, Tasty Tea was able to answer the following questions:

- Should the 120 tea bags package be replaced and if so, what would be the right package size?

- What is the price sensitivity for Tasty Tea and competitor products?

00:46:43 Final words and a story

Why is it important to use advanced research methods to develop your product selection instead of just copying what your competitors are doing? Apramey answers this question with a cautionary real-life story.

00:48:00 Q&A

The experts answer audience questions on MaxDiff, TURF and CB-conjoint analysis.

Like what you see? Watch the full webinar.

We encourage you to see what other topics we've covered in our on-demand sessions!